What Massachusetts Buyers, Sellers, and Lenders Need to Know About the New Stewart Title Rate Manual

On September 15, 2025, Stewart Title released a new Massachusetts Rate Manual. It changes how title insurance premiums are calculated. These updates affect buyers, sellers, and lenders across the Commonwealth.

At Sherman Law, we guide clients through every part of a closing. That includes making sure you understand these new rates.

Why the Rate Manual Matters

The Rate Manual sets the cost of title insurance policies. These policies protect buyers and lenders against problems with the property’s title.

The new rules apply to:

-

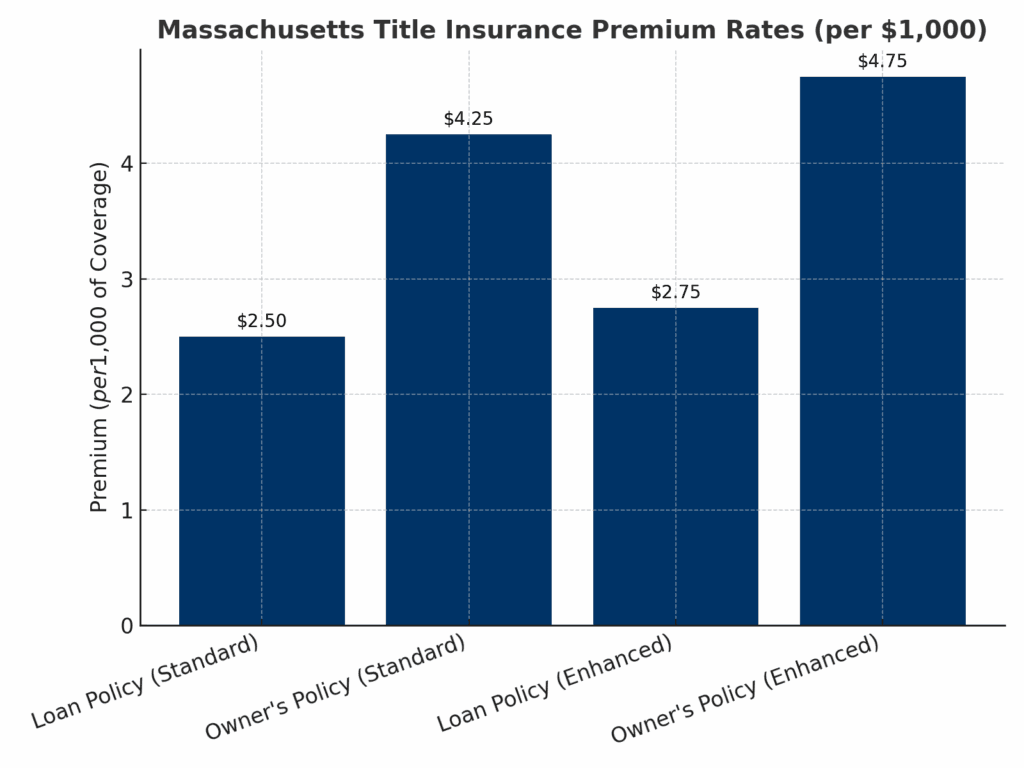

Owner’s Policies (Standard and Enhanced)

-

Loan Policies (Standard and Enhanced)

-

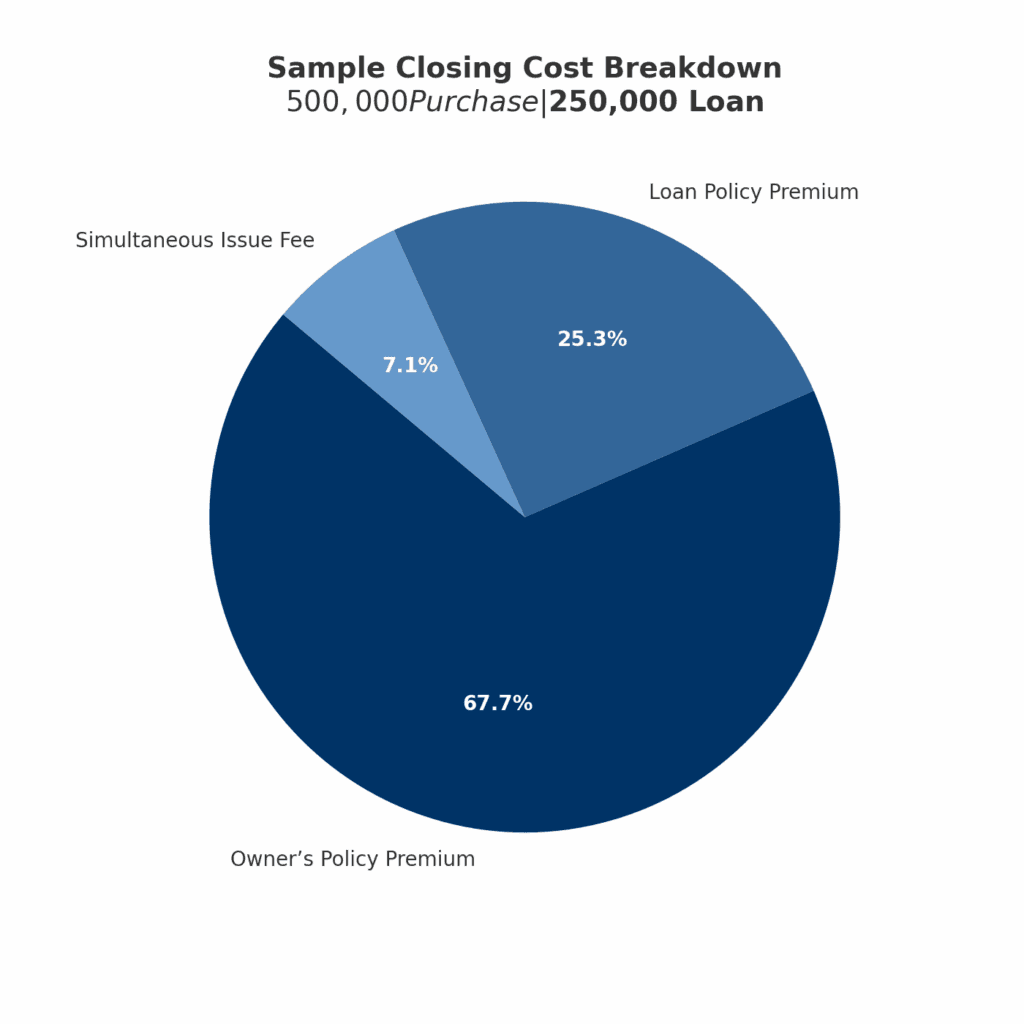

Simultaneous Policies (when both owner’s and loan coverage are issued together)

Knowing the changes helps buyers plan for costs. It also ensures Realtors, lenders, and attorneys follow the right guidelines.

Key Highlights of the 2025 Stewart Title Manual

3. Refinance Rate

Refinances now receive a 40% discount on the loan policy premium, as long as the property already has a mortgage.

4. Special Situations

-

Negative Amortization Loans: Coverage may be up to 110% of the loan.

-

Reverse Mortgages: Coverage may be up to 150% of the loan.

-

Second Mortgages/HELOCs: Extra simultaneous fees apply.

5. Closing Protection Letter (CPL) Fee

A $35 CPL fee applies to each transaction. A second mortgage or HELOC with another lender adds another $35.

What This Means for Buyers and Lenders

These updates bring more clarity to title insurance costs. Buyers should plan for premiums early. Realtors and lenders can use the new rules to set clear expectations from the start.

At Sherman Law, we explain these details up front so clients don’t face surprises on closing day.

FAQ

Q: Do I get a discount if I refinance?

A: Yes. Refinances receive a 40% discount on loan policy premiums.

Q: What’s the difference between Standard and Enhanced policies?

A: Enhanced policies provide broader coverage. They may cover issues like zoning, encroachments, or missing permits.

Q: How does a simultaneous policy save money?

A: Instead of paying two full premiums, you pay the owner’s policy premium plus a small fee.

How Sherman Law Can Help

The Stewart Title manual can look complex. But you don’t have to navigate it alone. Our attorneys have decades of experience with Purchase & Sale Agreements, refinances, closings, and title reviews. We make sure premiums are correct and closings are stress-free.

About Sherman Law

With offices in Hingham, Plymouth, Boston, and Dartmouth, we focus exclusively on residential real estate. Our attorneys and paralegals use modern tools to streamline each closing. Most importantly, we stay available when you need us—not just 9 to 5.

📞 Call or text us at 781-664-4936

📧 Email: tim@timshermanlaw.com